Ergebnisse der ersten European Cargo Bike Industry Survey liegen vor. 38 Cargobike-Marken haben Verkaufsdaten geliefert.

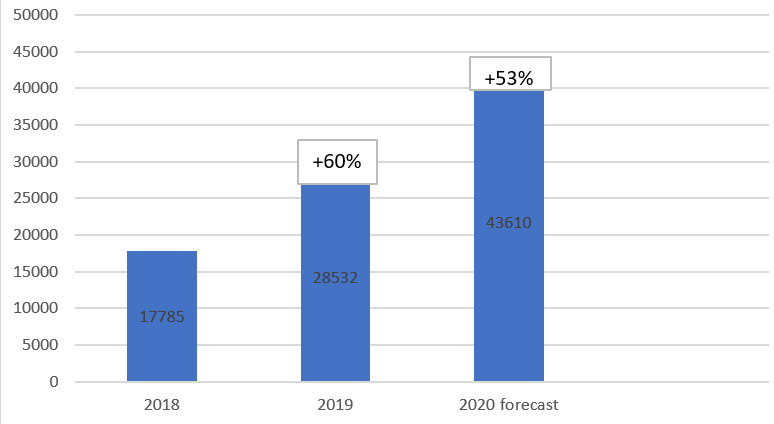

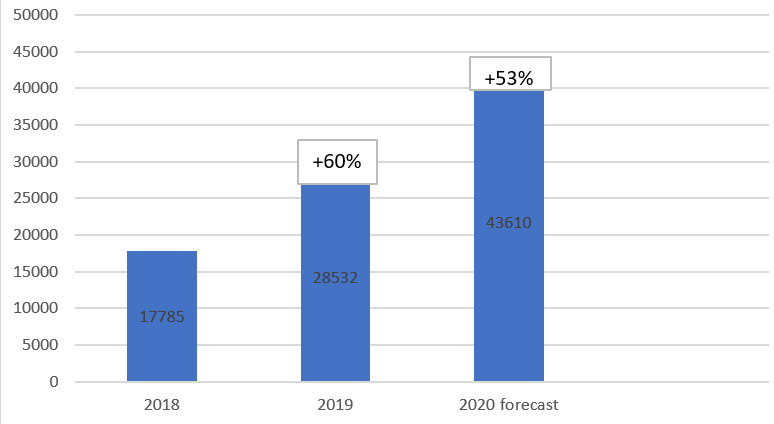

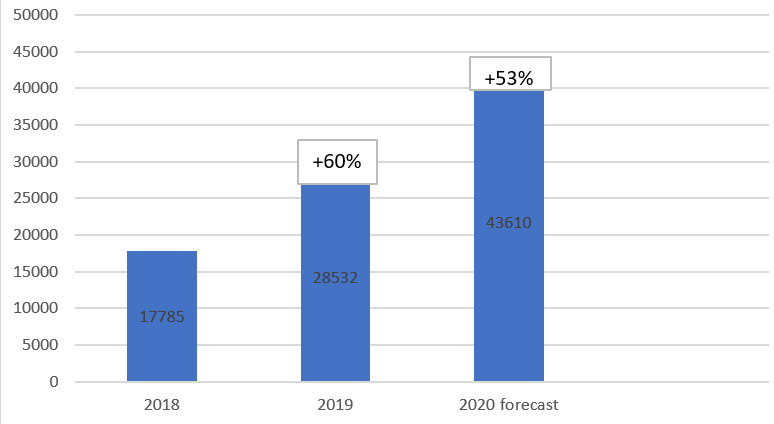

Der europäische Lobbyverband Cycling Industries Europe (CIE) und cargobike.jetzt haben Ergebnisse der ersten European Cargo Bike Industry Survey veröffentlicht. Anonym erhobene Daten von 38 Cargobike-Marken ergeben ein eindrucksvolles Wachstum ihrer europaweiten Cargobike-Verkäufe. Von 2018 auf 2019 betrug das Wachstum rund 60 Prozent. Und trotz Corona-Krise erwarten die Unternehmen für 2020 ein weiteres Wachstum um rund 53 Prozent.

Läuft die Verkehrswende in Europa also bereits? Keineswegs! Mein Kommentar in der heutigen Pressemitteilung zu den Umfrageergebnissen:

[…] in vielen Regionen steht die Cargobike-Revolution noch ganz am Anfang. Verkehr ohne CO2-Emissionen, bessere Luftqualität und die Zurückgewinnung von öffentlichem Straßenraum erfordert mehr politische Förderung von nachhaltigen Fahrzeugen wie Cargobikes.

Dafür setzt sich das europäische CityChangerCargoBike-Projekt ein, in dessen Rahmen die Umfrage entstand.

Deutscher Markt von zentraler Bedeutung

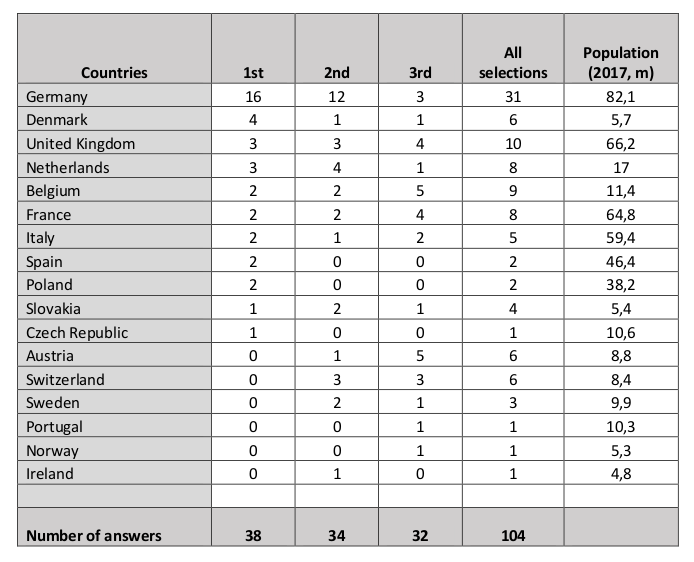

Von besonderem Interesse hierzulande dürfte sein: 16 der 38 Cargobike-Marken gaben Deutschland als ihren wichtigsten Markt in Europa an. Dahinter folgt das Cargobike-Mekka Dänemark mit vier Nennungen. Neben der Bevölkerungsgröße (Deutschland ist größtes Land der EU und 14x größer als Dänemark) tragen sicher auch die zahlreichen Kaufprämien-Überblick zur Bedeutung des deutschen Marktes bei.

Die Umfrage analysiert auch die Anteile verschiedener Modelltypen an den Verkäufen: nach Nutzungsart (privat/gewerblich), Antrieb (ohne/mit E-Motor) und Räderzahl (2/3/mehr). Hinzu kommt eine Aufschlüsselung der 38 anonymen Cargobike-Marken nach Anzahl ihrer Verkäufe. Im Frühjahr 2021 ist eine Wiederholung der European Cargo Bike Industry Survey vorgesehen.

Alle Umfrageergebnisse und weitere Infos zur Studie sind auf dieser Seite unten dokumentiert.

-> Pressemitteilung

-> Umfrageergebnisse

-> Methodik und Beteiligte

—

Editorische Notiz: cargobike.jetzt ist Partner des CityChangerCargoBikeProjekts und hat die Umfrage koordiniert. Auf der cargobike.jetzt-Themenseite Potentiale & Marktgröße sind weitere Studien und Umfragen zum Cargobike-Markt zu finden.

Press release

Cargo bike boom in Europe

Industry survey expects over 50 percent market growth in 2020

Brussels/Berlin, 6 July 2020

Today, the EU-funded CityChangerCargoBike project released key results of the first European Cargo Bike Industry Survey. These results are based on anonymised sales data provided by 38 cargo bike brands.

After selling 17,800 cargo bikes in 2018 and 28,500 in 2019 the 38 survey participants expect to sell 43,600 cargo bikes across Europe in 2020. While this anonymised sample of cargo bike brands cannot account for the total size of the European cargo bike market, it clearly indicates its trends and impressive growth.

In 2019, sales of survey participants grew by around 60 percent. And despite the timing of the survey during the Coronavirus lockdown in May, they expect an ongoing rapid increase of 53 percent for 2020.

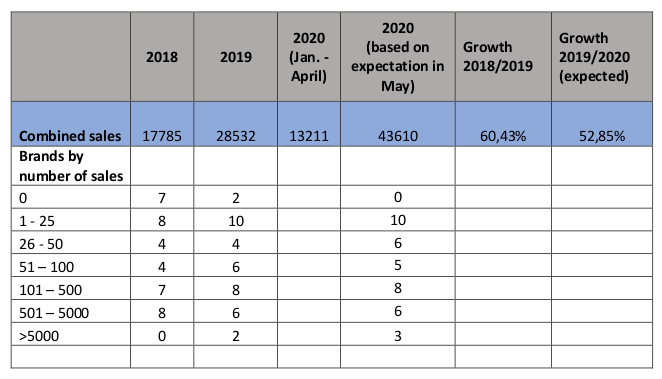

Seven of the 38 brands are newcomers with no sales in 2018. While in 2018 none of the 38 surveyed brands sold more than 5,000 cargo bikes, three of them expect do so in 2020. This shows the diversity and dynamism of the cargo bike industry with many young and still small brands and an increasing number of bigger players.

The survey also asked each brand for the sales share of different cargo bike types and for their main national markets in Europe. Results:

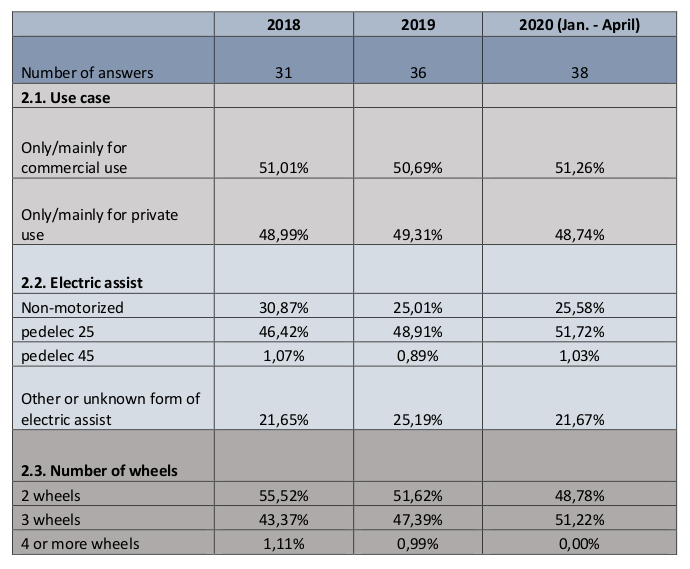

Sales of cargo bikes for private and for commercial use are growing equally fast. Their market shares remain almost equal.

The majority of cargo bikes are sold with electric assist and their share of the market is growing. The share of cargo bikes without electric assist decreased from around 31 percent in 2018 to around 25 percent in 2019.

Sales of three wheeler cargo bikes are growing a little faster than two wheelers. Their share is almost equal in expected sales for 2020. Four wheeled cargo bikes are yet to play a significant role.

Germany is the most important national market in Europe for 16 of the 38 survey participants. Denmark (with a population 14 times smaller) was selected 4 times, UK and the Netherlands 3 times. But the European cargo bike market is not limited to only a few top markets. 17 countries are among the top three markets of at least one of the survey participants.

Kevin Mayne, CEO Cycling Industries Europe and partner of the CityChangerCargoBike project, commented:

We have identified for some time that the cargo and delivery bike market has really high potential for the cycling industries of Europe. This survey makes me very confident that we are on the right track, with the sector doing well and a diverse range of vehicles increasingly meeting all market needs across Europe.

Berlin based cargo bike expert Arne Behrensen, editor of cargobike.jetzt and co-ordinator of the survey, added:

50 – 60 percent annual market growth is in line with observations of CityChangerCargoBike partners who promote cargo bike use across Europe. But in many regions the cargo bike revolution is still in a very early stage. Decarbonizing transport, improving air quality and regaining public street space needs more political support for sustainable vehicles like cargo bikes.

A study by CityChangerCargoBike project leader FGM-AMOR already in 2013 showed a huge potential for cargo bikes and was quoted by the EU transport ministers‘ 2015 declaration on cycling: “more than half of all motorized cargo trips in EU cities could be shifted to bicycles”.

The European Cargo Bike Industry Survey will be repeated in spring 2021.

Media inquiries:

→ Arne Behrensen, cargobike.jetzt: arne.behrensen@cargobike.jetzt

→ Ayse Sumer, Cycling Industries Europe: a.sumer@cyclingindustries.com

Background:

The CityChangerCargoBike (CCCB) project‘s mission is to fully exploit the huge potential of cargo bikes in Europe. It includes 16 partner cities from Lisbon in Portugal to Gdynia in Poland. The project is supported by the European Union‘s Horizon2020 programme from 2018 to 2021.

www.cyclelogistics.eu

The trade organisation Cycling Industries Europe (CIE) coordinates the European Cargo Bike Expert Group as part of the CCCB project. The expert group is open to all companies, institutions and experts with stakes in the cargo bike sector.

www.cyclingindustries.com

cargobike.jetzt is a Berlin-based consultancy and blog specialised in promoting cargo bikes. Editor Arne Behrensen coordinated the European Cargo Bike Industry Survey.

www.cargobike.jetzt

First European Cargo Bike Industry Survey

Results

Brussels/Berlin, 6 July 2020

1. Sales growth of cargo bike brands

Question 1: „The total number of cargo bikes you sold in Europe in 2018 / 2019 / from January to April of 2020?“

Question 2: „How many cargo bikes do you expect to sell in Europe for the whole year 2020?“

Results based on answers of 38 anonymous cargo bike brands (EU-based: 35, other European: 2, non-European: 1):

2. Share of cargo bike types among sales of brands

Question: „Please, specify the share of different cargo bike types among your sales in Europe.“

Results based on answers of 38 anonymous cargo bike brands (EU-based: 35, other European: 2, non-European: 1):

3. Main markets of cargo bike brands

Question: „What are your three main national markets in Europe? Select the first/second/third country.“

Results based on answers of 38 anonymous cargo bike brands (EU-based: 35, other European: 2, non-European: 1):

More information

Press release

Methodology & Conductors

CityChangerCargoBike webpage

Inquiries:

→ Arne Behrensen, cargobike.jetzt: arne.behrensen@cargobike.jetzt

→ Ayse Sumer, Cycling Industries Europe: a.sumer@cyclingindustries.com

First European Cargo Bike Industry Survey

Methodology & Conductors

Berlin/Brussels, 6 July 2020

The European Cargo Bike Industry Survey was conduted as part of the European CityChangerCargoBike (CCCB) project by its partners European Cycle Logistics Federation (ECLF), cargobike.jetzt, Cycling Industries Europe (CIE) and Cracow University of Technology.

Data was collected online between 5 and 19 May 2020 during the Coronavirus lockdown through a password-protected Google form. No names or home countries of individuals or businesses were being sought in the survey, therefore no data can be assigned to individual brands. The data was received and aggregated by the CCCB project’s research partner Cracow University of Technology (Department of Transportation Systems).

The questionaire included these definitions on the survey‘s scope:

A cargo bike in the sense of this survey is a bicycle with a higher than usual total maximum weight, specifically constructed for the private or commercial transport of goods or people (including rickshaws and postal bikes).

The survey is limited to cargo bike sales and cargo bike specific business in the European Union + the UK, Norway, Iceland, Switzerland, and the Balkan countries.

The survey link was disseminated through established national, European and international industry channels by e-mail, trade magazines and social media. 44 cargo bike brands shared their sales data as well as expected sales for the whole year 2020. Six of the 44 brands had no sales yet until April 2020.

Sample size and answers of the remaining 38 brands justify the assumption that their sales reflect to a realistic extent the growth and trends of the whole cargo bike market in Europe. However, the survey’s sample cannot account for the total size of the European cargo bike market.

It is very likely that the timing of the survey during the Coronavirus lockdown in May led to rather cautious sales estimates for the whole year of 2020. The strong general increase in bike sales after the Coronavirus lockdown may further increase cargo bike sales in 2020.

The survey’s questionnaire included additional questions on the impact of the Corona crisis and also addressed additional target groups (dealers, suppliers, service providers). Sales trends of cargo bike brands turned out to be the most meaningful results and were singled-out for publication.

Some preliminary results were already shared via Twitter in late June 2020. Final results show a higher expected growth rate for 2020, were discussed and validated in CIE’s European Cargo Bike Expert Group and published with a joint press release by CIE and cargobike.jetzt on 6 July 2020.

More information

Press release

Survey results

CityChangerCargoBike webpage

Inquiries:

→ Arne Behrensen, cargobike.jetzt: arne.behrensen@cargobike.jetzt

→ Ayse Sumer, Cycling Industries Europe: a.sumer@cyclingindustries.com